Flagging global sales and Elon Musk’s increasingly outspoken political activities are combining to rock the value of Tesla.

Shares in the once-trillion-dollar company saw their worst day in five years this week. Year to date, Tesla’s stock has plunged 41% — though it is still up by about 36% over the past 12 months.

On Monday, the stock was down another 5%.

For Musk, Tesla’s shares remain his primary source of paper wealth, though he has also turned his stake in SpaceX into a personal lending tool. But it was proceeds from selling Tesla shares that helped Musk complete his acquisition of Twitter, now known as X.

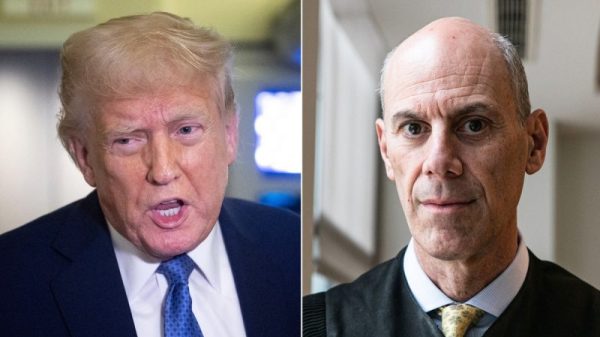

Musk’s wealth also allowed him to help vault Donald Trump into a second presidential term. Even as Musk’s net worth has diminished as a result of Tesla’s recent share-price declines, data suggests he is in no danger of losing his title as the world’s wealthiest person.

Musk has said on X that he is not concerned about Tesla’s recent drop in value. Still, evidence suggests the company is entering a period of transition.

A spokesperson for Tesla did not respond to a request for comment.

Musk’s wealth has propelled him to a global presence that lacks precedent — and has polarized world opinion about the tech entrepreneur in the process. Any weakening of his financial position, therefore, could undercut his influence in the political and tech spaces where he now commands outsize attention.According to Bank of America, Tesla’s European sales plummeted by about 50% in January compared with the same month a year prior.

Some say this is attributable to a growing distaste for Musk, who has begun dabbling in the continent’s politics in the wake of his successful support of Trump’s candidacy last year.

Others note Tesla’s European market is facing increased competition from the Chinese electric-vehicle maker BYD, which has telegraphed ambitious plans for expansion on the continent.

A more decisive blow to Tesla’s near-term fortunes may be emanating from China itself. There, Tesla’s shipments plunged 49% in February from a year earlier, to just 30,688 vehicles, according to official data cited by Bloomberg News. That’s the lowest monthly figure registered since July 2022 — amid the throes of Covid-19 — when it shipped just 28,217 EVs, Bloomberg said.