The global platinum market is projected to face its third consecutive deficit in 2025 with a shortfall of 539,000 ounces, according to the latest quarterly report from the World Platinum Investment Council (WPIC).

Demand across key sectors remains robust, outpacing mine production and recycling efforts.

The projected 2025 deficit will come after an expected shortfall of 682,000 ounces in 2024, driven by steady demand of 7,951,000 ounces against constrained supply of 7,269,000 ounces.

For 2025, the WPIC forecasts only slight changes, with demand set to come in at 7,863,000 ounces — representing a marginal 1 percent year-on-year decline — and supply increasing by 1 percent to 7,324,000 ounces.

Platinum supply still facing challenges

Platinum supply rose by 7 percent year-on-year in Q3, but still remains constrained.

Overall, mine supply is projected to grow by just 1 percent in 2024 to 5,683,000 ounces, a level reflective of ongoing industry challenges, such platinum’s rangebound price level and restructuring activities.

Looking ahead to 2025, mine output is forecast to contract by 2 percent to 5,550,000 ounces.

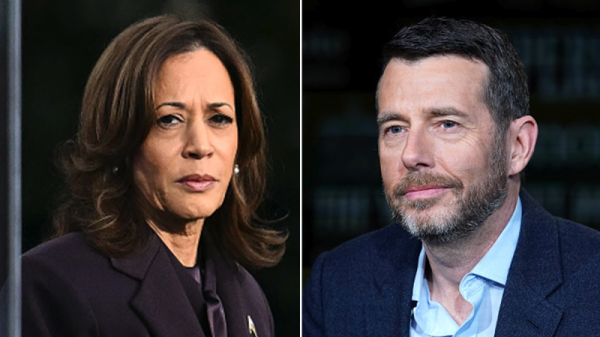

Watch Edward Sterck, director of research at the WPIC, discuss the organization’s latest report.

Meanwhile, platinum recycling — a key component of supply — is showing signs of recovery.

A 3 percent year-on-year improvement is expected in 2024, bringing recycled volumes to 1,587,000 ounces. In 2025, recycling is projected to increase by 12 percent to 1,774,000 ounces, 8 percent below pre-pandemic averages.

Total aboveground stocks of platinum are forecast to decline significantly, falling by 16 percent in 2024 and 15 percent in 2025, which the WPIC said highlights the ongoing supply/demand imbalance.

Auto sector demand to hit eight year high

The automotive industry is set to be a key driver of platinum demand in 2025, with consumption from the sector projected to hit 3,245,000 ounces, marking an eight year high.

This growth contrasts with a 2 percent decline in 2024 to 3,173,000 ounces. According to the WPIC, this decrease was largely due to revised vehicle production forecasts in Europe amid economic challenges.

The anticipated rebound in 2025 reflects increased use of platinum in hybrid vehicles, as well as substitution of platinum for palladium in catalytic converters. These trends are supported by stricter emissions regulations and the sustained production of internal combustion engine vehicles as electric vehicle adoption lags.

Meanwhile, the WPIC anticipates that global jewelry demand for platinum will rise steadily both this year and next, driven by strong fabrication growth in key markets like India, Japan and North America.

In 2024, jewelry demand is forecast to increase by 5 percent year-on-year to 1,951,000 ounces. This upward trajectory is set to continue into 2025, with a further 2 percent increase to 1,983,000 ounces.

Indian demand remains a key growth driver, supported by innovative designs and cultural trends, while the North American and Chinese markets are expected to show modest gains.

Industrial demand to decline, investment demand to grow

Industrial demand for platinum is projected to decline by 9 percent in 2025 to 2,216,000 ounces.

This follows a period of strong growth fueled by expansions in sectors like glass and hydrogen production. The slowdown in 2025 is largely attributed to reduced demand in the glass sector as capacity expansions taper.

However, other industrial applications, including chemical and hydrogen sectors, are expected to show growth, as platinum’s applications in emerging technologies continue to diversify.

In contrast, investment demand for platinum is projected to remain a key component of the market in 2025, marking the third consecutive year of net positive growth, as per the WPIC.

Total investment demand is forecast to rise by 7 percent in 2025 to reach 420,000 ounces, supported by increased interest in platinum bars and coins, particularly in China.

Exchange-traded funds are also expected to see growth, with US investors turning to platinum as part of broader investment strategies tied to industrial metals.

Platinum price showing resilience

With a variety of factors driving the platinum outlook, WPIC CEO Trevor Raymond expressed optimism that the metal’s growing industrial and investment uses will soon translate to a more stable market.

“At a time when the global economy is uncertain, one might expect an industrial metal like platinum to perform poorly. However, as we see in today’s findings, platinum demonstrates its resilience due to its diverse end-uses even in the current environment,” he explained in the WPIC’s report.

One such area is platinum’s growing role in green hydrogen and emissions-reduction technologies. The metal’s strategic importance is expected to rise, offering opportunities for long-term investors and industry stakeholders.

Furthermore, the increased availability of physical platinum — including retail giant Costco’s (NASDAQ:COST) initiative to sell platinum bars and coins — is set to serve as a tailwind for the sector’s future outlook.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.